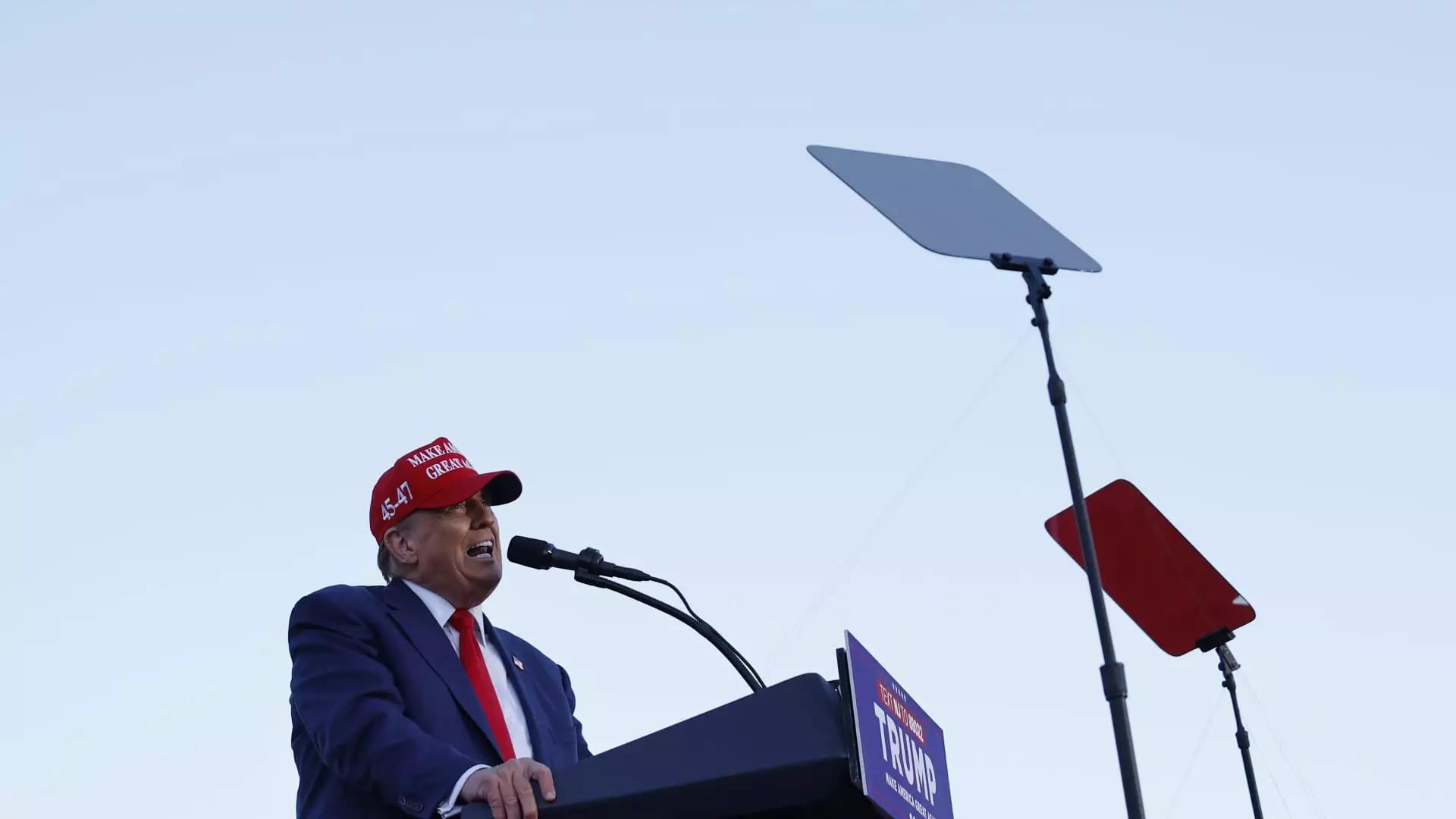

As we approach the end of 2025, Americans are facing a looming tax crisis that could have significant implications for individual taxpayers. The Tax Cuts and Jobs Act of 2017, enacted by former President Donald Trump, is set to expire next year, leading to the expiration of trillions of dollars in tax breaks. With control of the White House and Congress uncertain, the future of these tax provisions is up in the air. In this article, we will delve into the key provisions of the TCJA and how they have impacted individual taxpayers, as well as explore the potential changes that could occur after 2025.

One of the most significant changes brought about by the TCJA was the reduction of federal income tax rates across the board. The top rate was lowered from 39.6% to 37%, providing relief for many taxpayers. However, these lower rates are set to expire after 2025 unless Congress takes action. This could mean a return to pre-TCJA rates of 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%. High-income earners have been taking advantage of these lower rates by accelerating income and implementing tax planning strategies to minimize their tax burden.

The TCJA nearly doubled the standard deduction, making it less likely for taxpayers to itemize deductions. However, if the standard deduction reverts to 2017 levels after 2025, more filers may opt to itemize their deductions to reduce taxable income. The $10,000 cap on state and local tax deductions has been a contentious issue, particularly for residents of high-tax states like California, New Jersey, and New York. The scheduled expiration of this cap in 2025 could have significant implications for these taxpayers.

The TCJA increased the child tax credit and expanded eligibility, providing much-needed relief for families. Without action from Congress, these enhancements will revert to 2017 levels after 2025. Additionally, the federal gift and estate tax exemptions were raised through 2025, allowing ultra-wealthy individuals to transfer assets tax-free. However, these exemptions are set to decrease by about half in 2026 without new legislation. This has prompted some high-net-worth individuals to make lifetime gifts to avoid potential tax consequences.

The expiration of key provisions of the TCJA in 2025 has the potential to create a significant tax crisis for American taxpayers. It is important for individuals to be aware of these changes and plan accordingly to mitigate their tax liabilities. As the debate over these expiring provisions continues, it is crucial for taxpayers to stay informed and seek guidance from tax professionals to navigate the evolving tax landscape.