The recent market data has played a significant role in shaping Wall Street’s behavior. Despite softer retail sales and consumer price data for April, the major averages closed higher for the week. This paradoxical trend of bad news leading to good news on Wall Street has been driven by signals pointing to further disinflation. The Federal Reserve’s potential interest rate cut in 2024 is heavily reliant on this trend.

Economic Indicators

Various economic indicators, such as the U.S. single-family homebuilding and permits, have shown signs of slowing down. Industrial production also came in below expectations, further supporting the notion of disinflation. However, the producer price index exceeded estimates, indicating a slight increase in wholesale prices for April.

Despite the mixed economic indicators, the stock market rallied throughout the week. The S&P 500 reached a record high, closing above 5,300 for the first time. Additionally, the Dow Jones broke the 40,000 milestone and closed the week on a positive note. The S&P 500 rose by 1.5%, while the Nasdaq climbed by 2.1%.

Industry Performance

Within the S&P 500, technology emerged as the leading sector, followed by real estate and health care. However, industrials and consumer discretionary sectors experienced a decline. The current earnings season has been largely positive, with a majority of S&P 500 companies reporting positive surprises in both earnings and sales.

Upcoming Reports

Looking ahead, the focus will shift to housing reports scheduled for the upcoming week. The existing home sales and new home sales reports are crucial indicators for the housing market, which has been a persistent challenge for the Federal Reserve due to its impact on inflation. Housing costs contribute significantly to the overall consumer price index, creating pressure on consumers and limiting the Fed’s ability to cut rates.

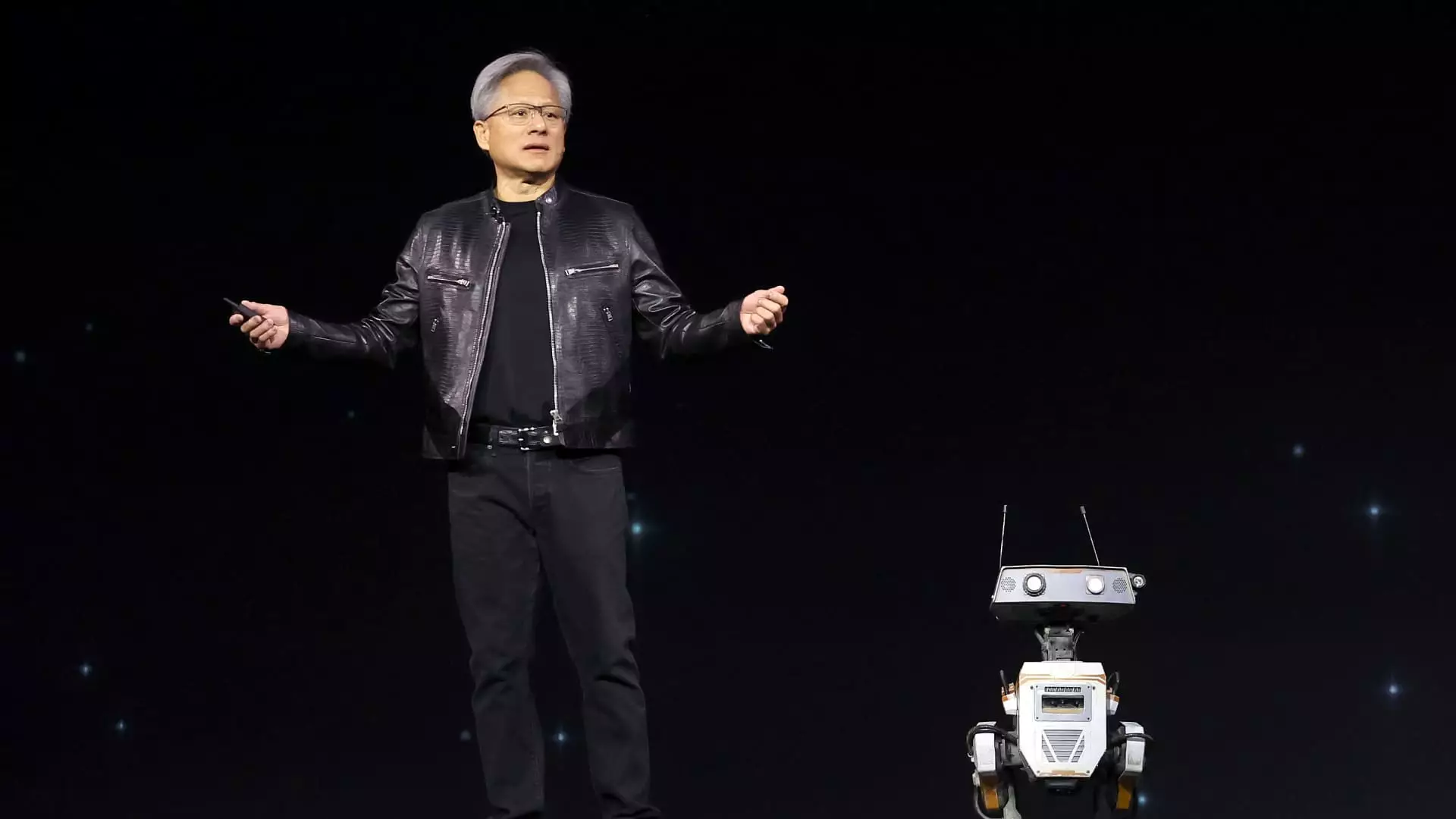

The upcoming earnings reports from three key portfolio companies will be closely watched. Palo Alto Networks, TJX Companies, and Nvidia are expected to provide insights into their respective industries. Palo Alto Networks’ strategic shift towards platformization, TJX Companies’ focus on consumer spending trends, and Nvidia’s lead in AI chips and software updates will be key areas of interest for investors.

As a subscriber to the CNBC Investing Club with Jim Cramer, investors have access to trading alerts before Jim makes any trades. The strict guidelines followed by Jim in executing trades ensure transparency and accountability in his investment decisions. Investors can leverage this information to make informed decisions in their own trading activities.

The recent market data and economic indicators have influenced Wall Street’s performance and investor sentiment. The paradoxical nature of bad news leading to good news reflects the complex dynamics of the financial markets. As investors navigate through the upcoming reports and earnings releases, staying informed and analyzing trends will be crucial for making sound investment decisions.