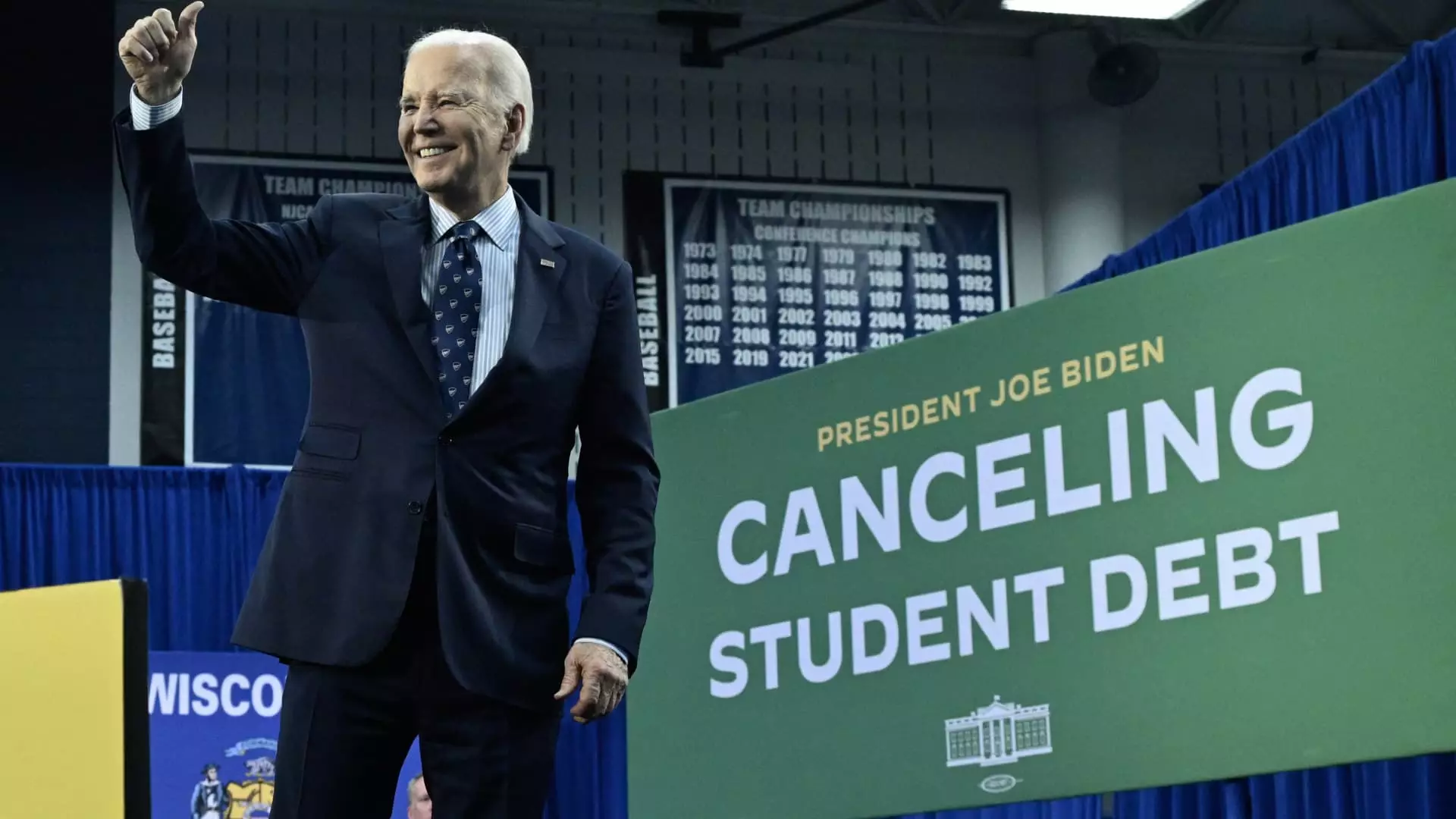

President Joe Biden is aiming to alleviate the burden of student loan debt for millions of Americans by forgiving a significant portion of their loans before the upcoming presidential election in November. The administration’s proposal, outlined in the Federal Register in April, has received an overwhelming response from the public, with over 34,000 comments submitted during the 30-day public comment period. This level of engagement indicates the importance of the issue and the varying opinions surrounding it.

The public feedback on President Biden’s revised student loan forgiveness plan, known as Plan B, reflects a diverse range of perspectives on the matter. While some individuals express support for the initiative, citing personal struggles with excessive student loan debt and the challenges of repayment in the current economic climate, others voice strong opposition to the proposal. Critics argue that widespread debt cancellation would unfairly burden taxpayers who did not attend college or have already repaid their loans, while proponents emphasize the potential economic benefits and equity considerations.

Equity and Generational Wealth Disparities

One of the key arguments in favor of student loan forgiveness is the potential impact on marginalized communities, particularly those facing longstanding generational wealth disparities. Advocates for debt relief contend that individuals from backgrounds with limited access to financial resources, such as African Americans, stand to benefit significantly from the elimination of student loan debt. By addressing these historical inequities, proponents argue that student loan forgiveness represents a critical step towards economic empowerment and community investment.

Conversely, opponents of broad student loan forgiveness emphasize the importance of personal responsibility and individual financial decisions. Some critics argue that attending college is a personal choice that comes with sacrifices and trade-offs, and that students should be held accountable for their educational debt. This perspective highlights the concern that widespread debt cancellation could shift the responsibility of student loans onto taxpayers who did not directly benefit from higher education.

Challenges for Middle-Class Families

Middle-class families, in particular, face significant challenges related to student loan debt, often juggling various financial obligations alongside educational expenses. Individuals from working-class backgrounds express frustration with the complexities of navigating loan repayment programs and the long-term impacts of student debt on their financial well-being. For many, the pursuit of higher education has not led to the promised economic mobility, resulting in a sense of disillusionment and financial strain.

The debate surrounding President Biden’s student loan forgiveness plan reflects a complex interplay of economic, social, and political factors. While proponents advocate for equity, economic stimulus, and community investment, critics raise concerns about personal responsibility, taxpayer burdens, and the unintended consequences of widespread debt cancellation. As the administration considers the feedback from the public and policymakers, the future of student loan forgiveness remains a contentious and pressing issue with far-reaching implications for millions of borrowers nationwide.