On Monday, U.S. stocks saw an increase, building on gains from the previous session. This positive trend was fueled by a softer-than-expected jobs report, signaling that the Federal Reserve’s monetary tightening efforts were having a positive impact on the economy. Investors interpreted this as a step in the right direction towards potential interest rate cuts. Monday was described as a “benign week” for the market, with minimal economic releases or Federal Reserve communications expected to influence market sentiment in the upcoming days.

Former Starbucks CEO Howard Schultz highlighted the need for the coffee giant to enhance its U.S. store experience in order to regain customer trust. This call to action came after a disappointing quarter where management had to revise their full-year forecast downward, resulting in a sharp decline in the company’s stock value. While Schultz anticipated a challenging quarter, the severity of the results took many by surprise. Despite these setbacks, the Investing Club refrained from taking any immediate action on Starbucks stock, which showed a slight increase on Monday.

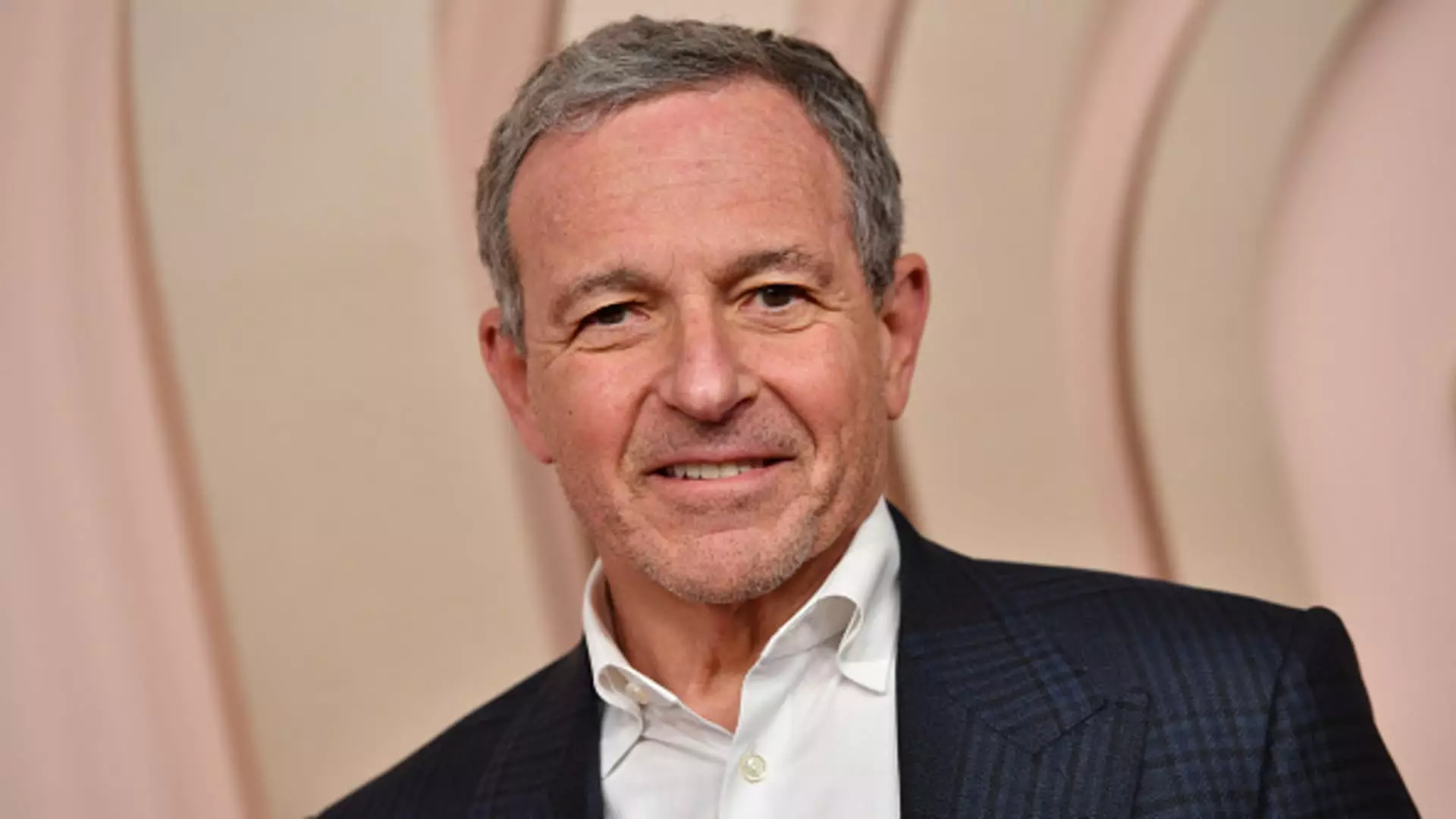

Shares of Walt Disney experienced a 1.5% increase following price target upgrades from Deutsche Bank and Loop Capital analysts. Disney is set to report its earnings on Tuesday, with particular focus on its direct-to-consumer business segment. Investors are hopeful for positive developments in this area, especially concerning the profitability of streaming services like Disney+ and Hulu. A potential breakeven point in this quarter could be welcomed news for shareholders.

As a subscriber to the CNBC Investing Club with Jim Cramer, traders are provided with trade alerts prior to any actions taken by Jim. It is standard practice for Jim to wait 45 minutes after issuing a trade alert before making any transactions in his charitable trust’s portfolio. Additionally, if Jim discusses a stock on CNBC TV, he observes a 72-hour waiting period before executing the trade. It is essential for members to review and understand the terms, conditions, privacy policy, and disclaimer provided by the Investing Club, as no fiduciary obligation or guaranteed profits are implied.

Staying informed about market trends and conducting thorough analysis before making investment decisions are critical for success in the stock market. Monitoring key developments, such as company earnings reports and analyst recommendations, can provide valuable insights for making informed trades. By following established guidelines and being proactive in tracking market movements, investors can increase their chances of achieving favorable outcomes in their trading activities.